Why Smart Budgeting Matters #

In today’s fast-paced world, mastering your finances is more important than ever. Smart budgeting isn’t just about cutting expenses—it’s about making your money work smarter for you. The average American household carries over $100,000 in debt, but with the right budgeting hacks, you can break free from the paycheck-to-paycheck cycle and start building real wealth.

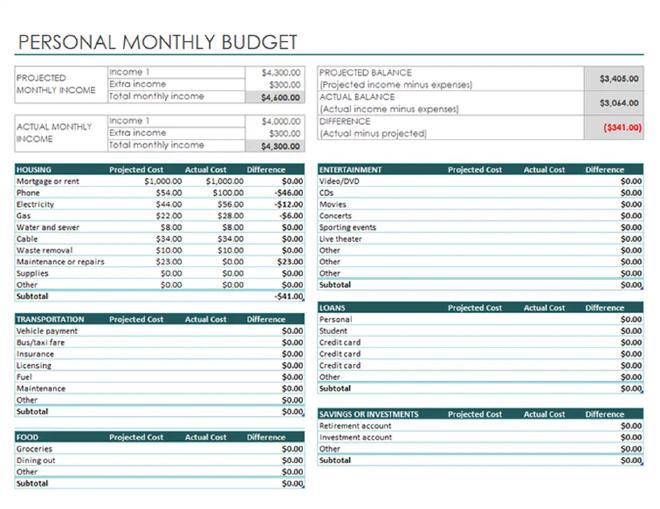

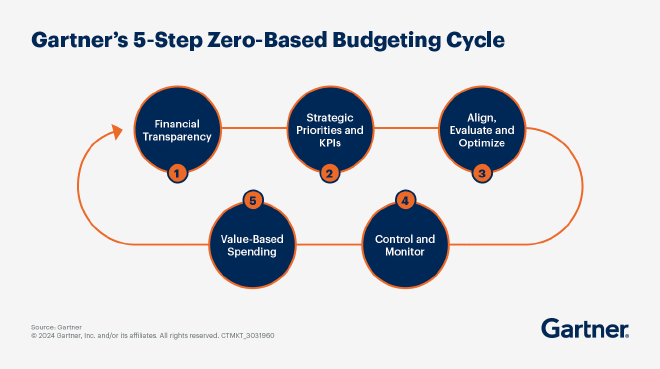

Hack 1: Zero-Based Budgeting #

Zero-based budgeting is one of the most effective budgeting hacks for taking control of your finances. Unlike traditional budgeting methods, this approach gives every dollar a specific purpose, ensuring nothing goes to waste.

What Is Zero-Based Budgeting? #

Zero-based budgeting means your income minus expenses equals zero. Every dollar you earn is assigned to a specific category: bills, savings, investments, or discretionary spending. This method forces you to be intentional with your money and helps identify areas where you can cut back.

How to Implement Zero-Based Budgeting #

Start by listing all your income sources and fixed expenses. Then, allocate the remaining money to savings goals and variable expenses. Use a budgeting app or spreadsheet to track your progress. Remember, the goal isn’t to spend everything—it’s to give every dollar a purpose.

Hack 2: The Envelope System #

The envelope system is a classic budgeting hack that’s making a comeback in our digital age. It’s perfect for those who struggle with overspending in specific categories.

Understanding the Envelope System #

This cash-based system involves dividing your money into physical or digital envelopes for different spending categories. Once an envelope is empty, you can’t spend more in that category until the next budget period.

Making It Work for You #

Start with your most challenging spending categories, like dining out or entertainment. Allocate a specific amount to each envelope at the beginning of the month. For digital implementation, use separate bank accounts or budgeting apps that simulate the envelope system.

Hack 3: Automated Savings #

Automation is one of the most powerful budgeting hacks for building wealth effortlessly. By setting up automatic transfers and payments, you remove the temptation to spend money that should be saved.

Setting Up Automatic Transfers #

Begin by automating your savings. Set up recurring transfers to your savings account right after payday. Even small amounts add up over time. Consider using apps that round up your purchases and save the difference.

Automating Bill Payments #

Automate all your regular bills to avoid late fees and maintain a good credit score. Use your bank’s bill pay feature or set up automatic payments directly with service providers.

Hack 4: Top Budgeting Apps #

Modern technology has revolutionized personal finance. The right budgeting app can make implementing these budgeting hacks much easier.

Best Budgeting Apps of 2025 #

- Mint - Comprehensive financial tracking

- YNAB (You Need A Budget) - Zero-based budgeting made easy

- PocketGuard - Simple spending tracking

- GoodBudget - Digital envelope system

- Personal Capital - Investment-focused budgeting

Choosing the Right App #

Consider your specific needs:

- Do you need investment tracking?

- Are you comfortable linking bank accounts?

- Do you prefer manual or automatic categorization?

Hack 5: Meal Planning for Cost Control #

Food expenses often represent the largest variable in household budgets. Smart meal planning can significantly reduce your grocery bill while improving your health.

Creating a Meal Plan #

Start by planning meals for the week based on:

- What’s on sale at your local grocery store

- What you already have in your pantry

- Your family’s schedule and preferences

Smart Shopping Strategies #

- Shop with a list and stick to it

- Buy in bulk when items are on sale

- Consider store brands over name brands

- Use cashback apps for additional savings

Hack 6: The 24-Hour Rule #

Impulse buying is the enemy of smart spending. The 24-hour rule is a simple but effective budgeting hack to combat this.

How the 24-Hour Rule Works #

Before making any non-essential purchase over a certain amount (e.g., $50), wait 24 hours. This cooling-off period helps you determine if the purchase is truly necessary or just an impulse buy.

Implementing the Rule #

Set your personal threshold based on your budget. For some, it might be $20; for others, $100. The key is consistency and honesty with yourself about whether you really need the item.

Hack 7: Bulk Buying Strategies #

Bulk buying can lead to significant savings, but it requires careful planning to avoid waste.

Smart Bulk Buying #

Focus on non-perishable items and products you use regularly:

- Toilet paper and paper towels

- Cleaning supplies

- Dry goods like rice and pasta

- Personal care items

Avoiding Bulk Buying Pitfalls #

- Don’t buy more than you can use before expiration

- Consider storage space limitations

- Calculate the true cost per unit

- Watch for sales on regular-sized items

FAQ Section #

What is zero-based budgeting? #

Zero-based budgeting is a method where you assign every dollar of your income to a specific purpose, ensuring your income minus expenses equals zero. This approach helps you be more intentional with your money.

How much should I save each month? #

Financial experts recommend saving at least 20% of your income. However, start with what you can manage—even 5% is better than nothing. The key is consistency and gradually increasing your savings rate.

What’s the best budgeting app for beginners? #

For beginners, Mint and PocketGuard are excellent choices due to their user-friendly interfaces and automatic categorization features. They make implementing budgeting hacks much easier.

How can I stick to my budget? #

Set realistic goals, track your progress regularly, and celebrate small victories. Use automation tools and find an accountability partner to help you stay on track.

Is the envelope system still relevant in 2025? #

Absolutely! While the traditional cash envelope system has evolved, the principle remains powerful. Many modern apps simulate the envelope system digitally, making it more convenient than ever.

Conclusion & Next Steps #

Mastering these budgeting hacks is just the beginning of your financial journey. Remember, smart spending isn’t about deprivation—it’s about making intentional choices that align with your goals and values.

Start implementing these budgeting hacks one at a time, and you’ll be amazed at how quickly your financial situation improves. Remember, every small step counts, and consistency is key. Your journey to financial freedom begins now! 🌟